Vision of CXOs NextGen Initiative

About CXOs NextGen

About CXOs NextGen

Why this specialized MBA Program?

Unique Features of MBA in Finance with Superspecialisations in Corporate Finance, Investment Banking & Wealth Management:

- This is Country’s Only UGC Recognized Regular MBA Degree Finance which covers all exclusive modern domains of Finance namely Corporate Finance, Investment Banking & Wealth Management. It also has the best Subjects from Professional Courses including CFA (USA) & CA (India).

- This MBA Program has all subjects that are Industry-required & hence are designed & delivered exclusively by only CXOs & their Team Members. In the First Year of the MBA Program, the Students are taught by Industry Leaders practically in Classrooms & then in the Second Year of the MBA Program, it is followed up with Full Year Training in their Industries for hands-on practical experience before being finally Placed by such Industry Leaders.

- Only a few best Students are carefully onboarded every Year from amongst the Students who take admission for MBA Program in Finance at Chitkara University. The CXOs ensure a unique selection process to ensure Students who aspire to be different from the herd are chosen to be a part of this MBA Program. It’s not only the CGPAs that matter to get shortlisted in this Program but also other Life Skills, Values & Passion which are demanded by the Industry. We ensure such students onboarded understand the importance of honesty, hard work, dedication, and discipline and can be further groomed on such lines.

- All such subjects are regularly reviewed and updated by our Industry Mentors Panel & Advisory Board Members keeping in view the transitions in the Economy & Industry so as to align to the growing Profiles and not become redundant at any time. As a result, our students have been working & competing at various profiles where erstwhile only CAs or CFAs or Top B-Schools Postgraduates were preferred options.

- The uniqueness of the Subjects design & delivery and interaction with Top Industry Leaders during the course of journey helps meet the aspirations of CAs/CFAs/CSs aspirants & CAs/CFAs/CSs dropouts. The engagement with Industry Leaders helps augmenting deeper & different perspective to Business Owners/Entrepreneurial mindset Talent.

- You shall become an Integral part of the Top 3000 Business & Industry Leaders of the Country and hence the continuity to grow manifolds becomes a reality.

The Elite Mentors Team

“The process of making CXOs of Tomorrow from Amongst the Generation of Today.”

About CA (Dr) Aman Chugh

Founding Director- CXOs NextGen Center of Excellence in Finance

Chitkara University

CA (Dr) Aman Chugh, who has addressed over 1 Million Industry Professionals & Financial Advisors across 78 Countries including India, is a reputed name in the domain of Financial Markets, Portfolio Management & Derivatives. Having gained experience whilst working at Reputed Brands including PwC, E&Y (Dubai), GE (USA) & ICICI Bank in varied Profiles in Investment Banking, Corporate Banking, Derivatives & Risk Management, Financial Planning and Portfolio Management, he is presently a Consultant & Trainer to Fortune 500 Corporates; Govt Ministries & Associations; Regulators including RBI & SEBI; Banks & Financial Institutions; Large Consultancy Firms; Industry Associations & Reputed Universities in India and abroad apart from spearheading the CXOs NextGen Center of Excellence at Chitkara University. His views are often covered by reputed Print Media Houses and is regularly invited over National & Regional Media Channels. He happens to be one of the very few Doctorates in Currency & Interest Rate Derivatives during which he has evolved original theories on Risk Management using Derivatives useful for MSMEs & Large Corporates. He has also authored the First ever Practical Book on Currency & Interest rate Derivatives published by Pearson.

He has been Honored with the Titles “Guru of Financial Markets”, “Father of Financial Planning, Portfolio Management & Derivatives”. “Father of Financial Markets, Financial Planning & Risk Management” by various Professional Bodies including by The Institute of Cost Accountants of India (NIRC), The Institute of Chartered Accountants of India (Chandigarh), & SEBI recognized Association. He commands over 1.2 Million Searches over Google with a huge fan following on Social Media as well.

Selection Process

01

Robust Selection Criteria

02

Exclusively Designed Syllabus

03

Pre- Placement Offers

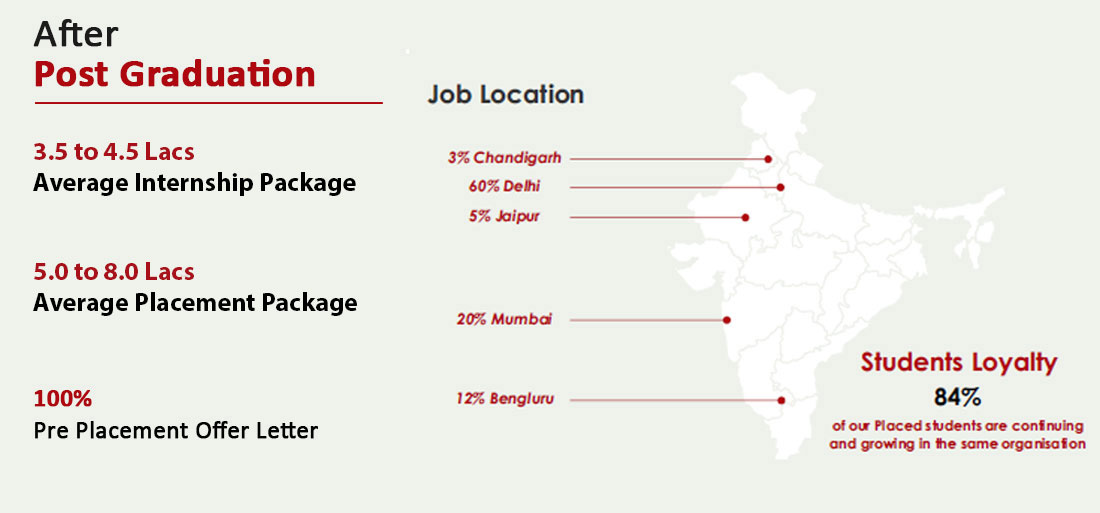

During the 2nd Year of the Program, the students undergo an uninterrupted internship/training (as Industrial Trainees or Employees in accordance with HR policy) in their choice of domain, exposed to benchmarks and best practices of the Industry that they join.

04

Practical Industry Training

During the internship/training period (as Industrial Trainees or Employees in accordance with HR policy), the students receive their Pre – Placement Offers based on their performance and merit from their respective employers. The students are open for any Job Locations across Globe.

#CXOs Speak

I connected with this initiative from the beginning itself way back in 2016, to share my practical experiences in Corporate World and enhance the Leadership skills, tools and methodologies of students to help them grow both as individuals and leaders of today and tomorrow. The students hired by us as Trainees during 2nd Year of the Program develops the students as front runners in the Organisations and we have seen them able to grab the Placement offers with ease. The students gain so wide exposure that they surely become Asset to any Organisation.”

I connected with this initiative from the beginning itself way back in 2016, to share my practical experiences in Corporate World and enhance the Leadership skills, tools and methodologies of students to help them grow both as individuals and leaders of today and tomorrow. The students hired by us as Trainees during 2nd Year of the Program develops the students as front runners in the Organisations and we have seen them able to grab the Placement offers with ease. The students gain so wide exposure that they surely become Asset to any Organisation.”CFO Mahindra

This Center of Excellence is a dynamic & innovative way of grooming the Finance Talent. It is quite broad based and gives a good balance of formal education and practical application. I was elated to see the level of Commitment, Willingness to learn, Optimism and Perseverance in the students. We are constantly working on content improvement and scalability so that students can gain consistency and coverage which ultimately help them gain aspiring Roles where right talent is hard to find.””

This Center of Excellence is a dynamic & innovative way of grooming the Finance Talent. It is quite broad based and gives a good balance of formal education and practical application. I was elated to see the level of Commitment, Willingness to learn, Optimism and Perseverance in the students. We are constantly working on content improvement and scalability so that students can gain consistency and coverage which ultimately help them gain aspiring Roles where right talent is hard to find.””CFO Wipro

This MBA program developed by us has amazing prospects and has already given great results. The students onbaorded at Knight Frank and other Companies have been able to compete with best Talent in the Country including CAs, CFAs and Premier B-School Students. This Initiative is unique in its way due to the practical orientation that is provided to the students through exclusive involvement by Industry starting from selecting the students, designing the industry required Subjects, grooming them in Classroom on such Subjects exclusively by Industry during their 1st Year of their Program and then onboarding as Trainees for full 2nd Year of the program before finally Placing them.”

This MBA program developed by us has amazing prospects and has already given great results. The students onbaorded at Knight Frank and other Companies have been able to compete with best Talent in the Country including CAs, CFAs and Premier B-School Students. This Initiative is unique in its way due to the practical orientation that is provided to the students through exclusive involvement by Industry starting from selecting the students, designing the industry required Subjects, grooming them in Classroom on such Subjects exclusively by Industry during their 1st Year of their Program and then onboarding as Trainees for full 2nd Year of the program before finally Placing them.”Director Knight Frank

The kind of passionate engagement of the Industry Leaders in the Program to build up the subjects which are futuristic & evolving and then delivering those Subjects is indeed commendable. The students are way ahead of many of their counterparts in all fields of Finance. It is heartening to see them replacing many CAs and CFAs in certain Profiles with ease.”-

The kind of passionate engagement of the Industry Leaders in the Program to build up the subjects which are futuristic & evolving and then delivering those Subjects is indeed commendable. The students are way ahead of many of their counterparts in all fields of Finance. It is heartening to see them replacing many CAs and CFAs in certain Profiles with ease.”-Country Head Citco

The rigorous efforts in selecting the students has started to attract the talent from every corner of the Country. The added references from amongst the CXOs network has also added to the talent pool. But obvious the Country's best CXOs teach the Country's best Talent Pool for their next journey is making all of us very Proud in shaping up the careers of many Young dynamic Minds willing to be different from the Crowd.”

The rigorous efforts in selecting the students has started to attract the talent from every corner of the Country. The added references from amongst the CXOs network has also added to the talent pool. But obvious the Country's best CXOs teach the Country's best Talent Pool for their next journey is making all of us very Proud in shaping up the careers of many Young dynamic Minds willing to be different from the Crowd.”Partner Ernst Young

I wanted to share my deep appreciation to CA Aman and Chitkara university for giving me opportunity to be in this unique forward-looking initiative. I must say that quality of engagement and knowledge of the students witnesses a marked improvement year on year. I am excited that this whole program will create a pool of candidates who are future ready given the deep knowledge they are getting from experts from industry. I wish all these young minds fly high & conquer the world”

I wanted to share my deep appreciation to CA Aman and Chitkara university for giving me opportunity to be in this unique forward-looking initiative. I must say that quality of engagement and knowledge of the students witnesses a marked improvement year on year. I am excited that this whole program will create a pool of candidates who are future ready given the deep knowledge they are getting from experts from industry. I wish all these young minds fly high & conquer the world”CFO Medtronics

With the ever-increasing competition among Candidates to be hired by the best and hirers looking for ready to be deployed resources, I personally feel this initiative has already been doing a great job; equipping the students with the right skill sets and making the soldiers battle ready. I must say, this vision of CA (Dr) Aman Chugh and his entire team, would also fall in line with the reforms being brought in the field of education by our government, since the new policy also focuses on imparting better skills and not just bookish knowledge. Further, they gain important skills such as Team Work, Coordination Problem Solving and Time Management, while they gain practical exposure with Corporate Partners like us for a full year during their Program. To summarize, they are already far well-equipped than the rest of the herd. Cannot ask for more!”

With the ever-increasing competition among Candidates to be hired by the best and hirers looking for ready to be deployed resources, I personally feel this initiative has already been doing a great job; equipping the students with the right skill sets and making the soldiers battle ready. I must say, this vision of CA (Dr) Aman Chugh and his entire team, would also fall in line with the reforms being brought in the field of education by our government, since the new policy also focuses on imparting better skills and not just bookish knowledge. Further, they gain important skills such as Team Work, Coordination Problem Solving and Time Management, while they gain practical exposure with Corporate Partners like us for a full year during their Program. To summarize, they are already far well-equipped than the rest of the herd. Cannot ask for more!”MD Deloitte

– I sincerely think that Country now implementing a whole new Education Policy, which was long overdue, the significance and future prospects of this initiative has enhanced manifold. The students onboarded by us have been amazingly hard working, committed, passionate and above all reduce the learning curve to rise and compete. With Industry Experts designing the curriculum and taking 100% classes themselves, there cannot be a better way of imparting authentic Industry required quality education in the changing scenarios. Being a part of this initiative since inception makes me feel so very proud that the quality of students has been increasing every year and hence more CXOs of the Country are getting attracted in finding the right Talent from such Pool of resources.”

– I sincerely think that Country now implementing a whole new Education Policy, which was long overdue, the significance and future prospects of this initiative has enhanced manifold. The students onboarded by us have been amazingly hard working, committed, passionate and above all reduce the learning curve to rise and compete. With Industry Experts designing the curriculum and taking 100% classes themselves, there cannot be a better way of imparting authentic Industry required quality education in the changing scenarios. Being a part of this initiative since inception makes me feel so very proud that the quality of students has been increasing every year and hence more CXOs of the Country are getting attracted in finding the right Talent from such Pool of resources.”CEO Car Dekho

This Center of Excellence in Finance is actually a Center of Excellence in all modern domains of Finance which is the need of the day. I appreciate the vision of Dr Chugh and University in shaping this up in a great manner. The best part is that the Industry is getting attracted to hire Talent from COE and also then also further build Subjects for their Profiles where Talent is hard to find rather than Student requiring to seek a Job. In fact Young aspiring Entrepreneurs should also be a part of this Program so that they could build the knowledge & network from this COE to build their Idea.”

This Center of Excellence in Finance is actually a Center of Excellence in all modern domains of Finance which is the need of the day. I appreciate the vision of Dr Chugh and University in shaping this up in a great manner. The best part is that the Industry is getting attracted to hire Talent from COE and also then also further build Subjects for their Profiles where Talent is hard to find rather than Student requiring to seek a Job. In fact Young aspiring Entrepreneurs should also be a part of this Program so that they could build the knowledge & network from this COE to build their Idea.”Senior Director Flipkart

#CXOs Speak

I connected with this initiative from the beginning itself way back in 2016, to share my practical experiences in Corporate World and enhance the Leadership skills, tools and methodologies of students to help them grow both as individuals and leaders of today and tomorrow. The students hired by us as Trainees during 2nd Year of the Program develops the students as front runners in the Organisations and we have seen them able to grab the Placement offers with ease. The students gain so wide exposure that they surely become Asset to any Organisation.”

I connected with this initiative from the beginning itself way back in 2016, to share my practical experiences in Corporate World and enhance the Leadership skills, tools and methodologies of students to help them grow both as individuals and leaders of today and tomorrow. The students hired by us as Trainees during 2nd Year of the Program develops the students as front runners in the Organisations and we have seen them able to grab the Placement offers with ease. The students gain so wide exposure that they surely become Asset to any Organisation.”CFO Mahindra

This Center of Excellence is a dynamic & innovative way of grooming the Finance Talent. It is quite broad based and gives a good balance of formal education and practical application. I was elated to see the level of Commitment, Willingness to learn, Optimism and Perseverance in the students. We are constantly working on content improvement and scalability so that students can gain consistency and coverage which ultimately help them gain aspiring Roles where right talent is hard to find.””

This Center of Excellence is a dynamic & innovative way of grooming the Finance Talent. It is quite broad based and gives a good balance of formal education and practical application. I was elated to see the level of Commitment, Willingness to learn, Optimism and Perseverance in the students. We are constantly working on content improvement and scalability so that students can gain consistency and coverage which ultimately help them gain aspiring Roles where right talent is hard to find.””CFO Wipro

This MBA program developed by us has amazing prospects and has already given great results. The students onbaorded at Knight Frank and other Companies have been able to compete with best Talent in the Country including CAs, CFAs and Premier B-School Students. This Initiative is unique in its way due to the practical orientation that is provided to the students through exclusive involvement by Industry starting from selecting the students, designing the industry required Subjects, grooming them in Classroom on such Subjects exclusively by Industry during their 1st Year of their Program and then onboarding as Trainees for full 2nd Year of the program before finally Placing them.”

This MBA program developed by us has amazing prospects and has already given great results. The students onbaorded at Knight Frank and other Companies have been able to compete with best Talent in the Country including CAs, CFAs and Premier B-School Students. This Initiative is unique in its way due to the practical orientation that is provided to the students through exclusive involvement by Industry starting from selecting the students, designing the industry required Subjects, grooming them in Classroom on such Subjects exclusively by Industry during their 1st Year of their Program and then onboarding as Trainees for full 2nd Year of the program before finally Placing them.”Director Knight Frank

The kind of passionate engagement of the Industry Leaders in the Program to build up the subjects which are futuristic & evolving and then delivering those Subjects is indeed commendable. The students are way ahead of many of their counterparts in all fields of Finance. It is heartening to see them replacing many CAs and CFAs in certain Profiles with ease.”-

The kind of passionate engagement of the Industry Leaders in the Program to build up the subjects which are futuristic & evolving and then delivering those Subjects is indeed commendable. The students are way ahead of many of their counterparts in all fields of Finance. It is heartening to see them replacing many CAs and CFAs in certain Profiles with ease.”-Country Head Citco

The rigorous efforts in selecting the students has started to attract the talent from every corner of the Country. The added references from amongst the CXOs network has also added to the talent pool. But obvious the Country's best CXOs teach the Country's best Talent Pool for their next journey is making all of us very Proud in shaping up the careers of many Young dynamic Minds willing to be different from the Crowd.”

The rigorous efforts in selecting the students has started to attract the talent from every corner of the Country. The added references from amongst the CXOs network has also added to the talent pool. But obvious the Country's best CXOs teach the Country's best Talent Pool for their next journey is making all of us very Proud in shaping up the careers of many Young dynamic Minds willing to be different from the Crowd.”Partner Ernst Young

I wanted to share my deep appreciation to CA Aman and Chitkara university for giving me opportunity to be in this unique forward-looking initiative. I must say that quality of engagement and knowledge of the students witnesses a marked improvement year on year. I am excited that this whole program will create a pool of candidates who are future ready given the deep knowledge they are getting from experts from industry. I wish all these young minds fly high & conquer the world”

I wanted to share my deep appreciation to CA Aman and Chitkara university for giving me opportunity to be in this unique forward-looking initiative. I must say that quality of engagement and knowledge of the students witnesses a marked improvement year on year. I am excited that this whole program will create a pool of candidates who are future ready given the deep knowledge they are getting from experts from industry. I wish all these young minds fly high & conquer the world”CFO Medtronics

With the ever-increasing competition among Candidates to be hired by the best and hirers looking for ready to be deployed resources, I personally feel this initiative has already been doing a great job; equipping the students with the right skill sets and making the soldiers battle ready. I must say, this vision of CA (Dr) Aman Chugh and his entire team, would also fall in line with the reforms being brought in the field of education by our government, since the new policy also focuses on imparting better skills and not just bookish knowledge. Further, they gain important skills such as Team Work, Coordination Problem Solving and Time Management, while they gain practical exposure with Corporate Partners like us for a full year during their Program. To summarize, they are already far well-equipped than the rest of the herd. Cannot ask for more!”

With the ever-increasing competition among Candidates to be hired by the best and hirers looking for ready to be deployed resources, I personally feel this initiative has already been doing a great job; equipping the students with the right skill sets and making the soldiers battle ready. I must say, this vision of CA (Dr) Aman Chugh and his entire team, would also fall in line with the reforms being brought in the field of education by our government, since the new policy also focuses on imparting better skills and not just bookish knowledge. Further, they gain important skills such as Team Work, Coordination Problem Solving and Time Management, while they gain practical exposure with Corporate Partners like us for a full year during their Program. To summarize, they are already far well-equipped than the rest of the herd. Cannot ask for more!”MD Deloitte

– I sincerely think that Country now implementing a whole new Education Policy, which was long overdue, the significance and future prospects of this initiative has enhanced manifold. The students onboarded by us have been amazingly hard working, committed, passionate and above all reduce the learning curve to rise and compete. With Industry Experts designing the curriculum and taking 100% classes themselves, there cannot be a better way of imparting authentic Industry required quality education in the changing scenarios. Being a part of this initiative since inception makes me feel so very proud that the quality of students has been increasing every year and hence more CXOs of the Country are getting attracted in finding the right Talent from such Pool of resources.”

– I sincerely think that Country now implementing a whole new Education Policy, which was long overdue, the significance and future prospects of this initiative has enhanced manifold. The students onboarded by us have been amazingly hard working, committed, passionate and above all reduce the learning curve to rise and compete. With Industry Experts designing the curriculum and taking 100% classes themselves, there cannot be a better way of imparting authentic Industry required quality education in the changing scenarios. Being a part of this initiative since inception makes me feel so very proud that the quality of students has been increasing every year and hence more CXOs of the Country are getting attracted in finding the right Talent from such Pool of resources.”CEO Car Dekho

This Center of Excellence in Finance is actually a Center of Excellence in all modern domains of Finance which is the need of the day. I appreciate the vision of Dr Chugh and University in shaping this up in a great manner. The best part is that the Industry is getting attracted to hire Talent from COE and also then also further build Subjects for their Profiles where Talent is hard to find rather than Student requiring to seek a Job. In fact Young aspiring Entrepreneurs should also be a part of this Program so that they could build the knowledge & network from this COE to build their Idea.”

This Center of Excellence in Finance is actually a Center of Excellence in all modern domains of Finance which is the need of the day. I appreciate the vision of Dr Chugh and University in shaping this up in a great manner. The best part is that the Industry is getting attracted to hire Talent from COE and also then also further build Subjects for their Profiles where Talent is hard to find rather than Student requiring to seek a Job. In fact Young aspiring Entrepreneurs should also be a part of this Program so that they could build the knowledge & network from this COE to build their Idea.”Senior Director Flipkart

Subjects Taught

- Financial Accounting

- Cost and Management Accounting

- Statistics for Managers

- Economics for Managers

- Excel for Managers

- Data Visualization & Communication

- Financial Management

- Organizational Behavior & Management Principles

- Marketing Management

- Business Research Methods

- Human Resource Management

- Corporate Communication

For Jobs in profiles including FP&A, Budgeting reports, Managing & Interpreting Cash Flows & Financials, building Commercial Pricing Decisions & Ops, with the touch of Blockchain technology and Artificial Intelligence as Corporate Finance Experts

- International Taxation

- MSME Banking & Finance

- Using Robotic Process Automation and Artificial Intelligence in Finance

- Blockchain Technology & Cryptocurrency

- Business Etiquettes, Leadership & Conflict Management

- Commercial Finance & Operations Finance (Including GST)

- Strategic Corporate Finance including FP&A (Budgeting, Reporting & Analysis)

- Financial Management & Financial Statement Analysis

- Mortgage Finance: Housing Finance (including Affordable) & Home Equity

- Finance & Accounts Shared Services

- Startup Ecospace

For Jobs in profiles including Building Financial Models, Conducting Due diligence and Feasibility Analysis, Managing the M&A deals with the touch of Big Data Analytics as Investment Bankers

- Valuation

- Risk Modeling

- Company Profiling

- Financial Modeling

- Pitchbook Essentials

- Trading Comparables

- Asset Backed Finance

- Transaction Comparables

- Data Modeling using Excel

- Big Data Analytics in Finance

- Data Visualization using Tableau

- Real Estate Modeling & Management

For Jobs in profiles including Managing Wealth, Research Analysts, Designing Risk Management techniques through Derivatives, with the touch of Technical & Fundamental Analysis as Wealth Advisors

- Equity & Equity Derivatives

- Currency & Commodity Derivatives

- Mutual Fund & its Technical Analysis

- Trend Trading using Technical Analysis

- International Financial Markets & Institutions

- Fundamental Analysis of Financial Instruments

#Alumni Speaks

It was privilege to learn directly from CXOs/Experts from all over India having hands on experience in their fields who also taught us the way to have positive outlook in everything. After Joining Volvo Cars, each day brought new challenges, but the learning from this course made everything easier. We were no less as compared to other peers from other reputed Institutes in terms of salary packages, exposure and knowledge. It's been 4 years now with Volvo Cars and no regrets since Day 1.

It was privilege to learn directly from CXOs/Experts from all over India having hands on experience in their fields who also taught us the way to have positive outlook in everything. After Joining Volvo Cars, each day brought new challenges, but the learning from this course made everything easier. We were no less as compared to other peers from other reputed Institutes in terms of salary packages, exposure and knowledge. It's been 4 years now with Volvo Cars and no regrets since Day 1.(Corporate Finance)

Finance & Accounts, Volvo Auto India

We were taught by the Professionals, who are amongst the Prestigious names in the Industry. They embraced us with practical skills along with the problem solving attitude. They gave us a fair of Corporate World by being in classroom itself. Even till today, we are connected with the professionals and it's like an extended family now, to whom we can reach out for the guidance whenever required.

We were taught by the Professionals, who are amongst the Prestigious names in the Industry. They embraced us with practical skills along with the problem solving attitude. They gave us a fair of Corporate World by being in classroom itself. Even till today, we are connected with the professionals and it's like an extended family now, to whom we can reach out for the guidance whenever required.(Corporate Finance),

Senior Business and Integration Architect Analyst,

Accenture

Things which make me different from my peers are discipline, punctuality & prior exposure of the corporate world which I got in this Program. Our mentor CA Dr Aman Chugh invites Professionals from big brands and start-ups, who teach us about the corporate culture, organizational behaviors, and make us market ready. The best part is our mentor is still the source of information and guidance. Presently I am working with one of the Big 4's and its all because of my confidence, clarity of thoughts, concepts & real world exposure which I got during this Program. “GO CONFIDENTLY IN THE DIRECTION OF YOUR DREAMS”

Things which make me different from my peers are discipline, punctuality & prior exposure of the corporate world which I got in this Program. Our mentor CA Dr Aman Chugh invites Professionals from big brands and start-ups, who teach us about the corporate culture, organizational behaviors, and make us market ready. The best part is our mentor is still the source of information and guidance. Presently I am working with one of the Big 4's and its all because of my confidence, clarity of thoughts, concepts & real world exposure which I got during this Program. “GO CONFIDENTLY IN THE DIRECTION OF YOUR DREAMS”(Corporate Finance)

Taxation, Deloitte

The structure of this course with its combination of 1 year rigorous study period in classrooms and then another 1 year training in the corporate world offers humongous exposure and pre - placement opportunities as it is designed and only taught by Industry led experts, CFOs, National Heads of MNCs which helped us to build connections and understand what is expected in the Industry! I would like to thank Chitkara University, CA (Dr) Aman Chugh and the Corporate Professionals for their continuous support and guidance throughout my journey which further helped me land an offer at the Big 4!

The structure of this course with its combination of 1 year rigorous study period in classrooms and then another 1 year training in the corporate world offers humongous exposure and pre - placement opportunities as it is designed and only taught by Industry led experts, CFOs, National Heads of MNCs which helped us to build connections and understand what is expected in the Industry! I would like to thank Chitkara University, CA (Dr) Aman Chugh and the Corporate Professionals for their continuous support and guidance throughout my journey which further helped me land an offer at the Big 4! (Corporate Finance), Business Assurance, Ernst Young

The Industry Experts brought to light a number of sectors such as Valuations and Advisory, Portfolio Management, Corporate Finance, Investment Advisory, Business Analysis and so on. Not only I got an engaging job, I got priority from seniors due to my wide knowledge and exposure. Before joining this Superspecialization we heard that the schedule is very tough and difficulty level will increase, but it was the opposite when we started this journey. It was full of Fun, Learning, Engaging, and Informative.

The Industry Experts brought to light a number of sectors such as Valuations and Advisory, Portfolio Management, Corporate Finance, Investment Advisory, Business Analysis and so on. Not only I got an engaging job, I got priority from seniors due to my wide knowledge and exposure. Before joining this Superspecialization we heard that the schedule is very tough and difficulty level will increase, but it was the opposite when we started this journey. It was full of Fun, Learning, Engaging, and Informative.(Investment Banking),

Investment Analysis

HSBC

The CXOs NextGen Program gave me a strong grounding in essential business areas, such as valuations and corporate finance. Learning from industry experts was especially invaluable, as their insights and optimistic perspective equipped me well for the challenges ahead. The program’s emphasis on practical learning and valuable industry connections played a crucial role in helping me in grooming. It's a program designed to empower students to reach their full potential.

The CXOs NextGen Program gave me a strong grounding in essential business areas, such as valuations and corporate finance. Learning from industry experts was especially invaluable, as their insights and optimistic perspective equipped me well for the challenges ahead. The program’s emphasis on practical learning and valuable industry connections played a crucial role in helping me in grooming. It's a program designed to empower students to reach their full potential.(Corporate Finance), Business Finance

DeeHat

The program has been an absolute game-changer for me. It's not just about acquiring new knowledge; it's about unlocking my full potential. The curriculum is designed to challenge and inspire, pushing me to reach heights I never thought possible.

What truly sets this course apart is the unwavering support of the mentors. They are not just guides; they are my constant cheerleaders and confidants. Their dedication is unparalleled. It's like having a personal backbone that keeps me grounded and motivated. They're always there to offer guidance, encouragement, and support, no matter what challenges I face. I am incredibly grateful for their belief in me and their commitment to my success.

The program has been an absolute game-changer for me. It's not just about acquiring new knowledge; it's about unlocking my full potential. The curriculum is designed to challenge and inspire, pushing me to reach heights I never thought possible.

What truly sets this course apart is the unwavering support of the mentors. They are not just guides; they are my constant cheerleaders and confidants. Their dedication is unparalleled. It's like having a personal backbone that keeps me grounded and motivated. They're always there to offer guidance, encouragement, and support, no matter what challenges I face. I am incredibly grateful for their belief in me and their commitment to my success.(Corporate Finance), FP&A, Thermofisher

They nourished us in such a manner that we were ready to outperform in the Corporate world. Be it the Financial Modeling, Risk Modeling, Valuation Modeling and many other in Investment Banking, OR be it the Fundamental Analysis, Technical Analysis, Live Stocks Trading in Wealth Management OR be it the Debt Securitization, Mortgage-backed Securities, Debt Syndication in Corporate Finance, we learned them all from Industry Professionals. Just because of those learnings, I was able to get into Fortune 500 Credit rating Company, Moodys as an Analyst. I would say my investment in this course has proved to be the best investment in my life.

They nourished us in such a manner that we were ready to outperform in the Corporate world. Be it the Financial Modeling, Risk Modeling, Valuation Modeling and many other in Investment Banking, OR be it the Fundamental Analysis, Technical Analysis, Live Stocks Trading in Wealth Management OR be it the Debt Securitization, Mortgage-backed Securities, Debt Syndication in Corporate Finance, we learned them all from Industry Professionals. Just because of those learnings, I was able to get into Fortune 500 Credit rating Company, Moodys as an Analyst. I would say my investment in this course has proved to be the best investment in my life.(Investment Banking),

Currently pursuing PhD in Finance

Earlier was in Business Analytics, Moodys

It’s been 4 years that I have entered into the Corporate World, and whenever there comes any situation where we do not know what to do, the learnings which I have received during this course has helped me to solve them. I always feel proud to be a part of this unique Program.

It’s been 4 years that I have entered into the Corporate World, and whenever there comes any situation where we do not know what to do, the learnings which I have received during this course has helped me to solve them. I always feel proud to be a part of this unique Program.(Corporate Finance & Investment Banking)

Debt Syndication, Acuity Knowledge Partners

Became part of this initiative in 2023, and this course has significantly contributed to my professional and personal growth. Instructed by leaders in the industry, the curriculum is rigourously crafted to concentrate on three key areas: Investment Banking, which emphasizes Financial Modelling and Valuation; Corporate Finance, which has enhanced my skills in evaluating Financial Statements and formulating strategies; and Wealth Management, which has equipped me to analyze Risk and Portfolio Management through the use of Derivatives.

Became part of this initiative in 2023, and this course has significantly contributed to my professional and personal growth. Instructed by leaders in the industry, the curriculum is rigourously crafted to concentrate on three key areas: Investment Banking, which emphasizes Financial Modelling and Valuation; Corporate Finance, which has enhanced my skills in evaluating Financial Statements and formulating strategies; and Wealth Management, which has equipped me to analyze Risk and Portfolio Management through the use of Derivatives. (Investment Banking),

Investment Banking

Colliers International

The program is well-developed whether you want to be an entrepreneur, work for a global brand, or help a startup scale. Apart from that, there's an extraordinary range of endless internship opportunities and entrepreneurial culture. This journey has pushed me to reach my full potential and has been well worth it as it has developed the skill set required for success in the business environment.

The program is well-developed whether you want to be an entrepreneur, work for a global brand, or help a startup scale. Apart from that, there's an extraordinary range of endless internship opportunities and entrepreneurial culture. This journey has pushed me to reach my full potential and has been well worth it as it has developed the skill set required for success in the business environment.(Corporate Finance),

Finance & Accounts, Medtronics

My experience during the MBA course was full of tremendous opportunities where I improved my overall personality, enhanced my knowledge and skills which are highly recommended in the corporate world. We had the privilege of getting directly connected with the top-level administrators of various reputed companies. I thoroughly enjoyed my journey in association with experienced faculties who were always ready to extend their helping hands towards us. The constant efforts and guidance made me corporate ready and as a result, I got placed in a multinational company which is a great opportunity for a fresher like me.

My experience during the MBA course was full of tremendous opportunities where I improved my overall personality, enhanced my knowledge and skills which are highly recommended in the corporate world. We had the privilege of getting directly connected with the top-level administrators of various reputed companies. I thoroughly enjoyed my journey in association with experienced faculties who were always ready to extend their helping hands towards us. The constant efforts and guidance made me corporate ready and as a result, I got placed in a multinational company which is a great opportunity for a fresher like me.(Corporate Finance),

Strategic Corporate Finance, KPMG

Alumni Speaks

It was privilege to learn directly from CXOs/Experts from all over India having hands on experience in their fields who also taught us the way to have positive outlook in everything. After Joining Volvo Cars, each day brought new challenges, but the learning from this course made everything easier. We were no less as compared to other peers from other reputed Institutes in terms of salary packages, exposure and knowledge. It's been 3 years now with Volvo Cars and no regrets since Day 1.”

It was privilege to learn directly from CXOs/Experts from all over India having hands on experience in their fields who also taught us the way to have positive outlook in everything. After Joining Volvo Cars, each day brought new challenges, but the learning from this course made everything easier. We were no less as compared to other peers from other reputed Institutes in terms of salary packages, exposure and knowledge. It's been 3 years now with Volvo Cars and no regrets since Day 1.”(Corporate Finance), Finance & Accounts, Volvo Auto India

We were taught by the Professionals, who are amongst the Prestigious names in the Industry. They embraced us with practical skills along with the problem solving attitude. They gave us a fair of Corporate World by being in classroom itself. Even till today, we are connected with the professionals and it's like an extended family now, to whom we can reach out for the guidance whenever required.”

We were taught by the Professionals, who are amongst the Prestigious names in the Industry. They embraced us with practical skills along with the problem solving attitude. They gave us a fair of Corporate World by being in classroom itself. Even till today, we are connected with the professionals and it's like an extended family now, to whom we can reach out for the guidance whenever required.”(Corporate Finance),

Project Development & Treasury Reconciliation

US based Ascent Technology

In this Company I have been directly working with a lot of CFOs and this program gave me a lot of confidence to interact with them. I turned out as a great asset for my Company proving myself in all areas of work. In case one is not happy with the job or is facing any issues, they can reach any time to our mentor Dr. CA Aman Chugh for any help and guidance and this is the major difference and the beauty of this program and the family.”

In this Company I have been directly working with a lot of CFOs and this program gave me a lot of confidence to interact with them. I turned out as a great asset for my Company proving myself in all areas of work. In case one is not happy with the job or is facing any issues, they can reach any time to our mentor Dr. CA Aman Chugh for any help and guidance and this is the major difference and the beauty of this program and the family.”(Investment Banking), Due Diligence & Funding

IPV (Inflection Point Ventures)

I learned new concepts related to Business Valuation, Merger & Acquisition, and Dis-investments which opened the doors of practical learning and on later stage which led to getting offers from renowned organisations. Based on my corporate journey, I have made up my mindset and gained confidence to open my own start-up.”-

I learned new concepts related to Business Valuation, Merger & Acquisition, and Dis-investments which opened the doors of practical learning and on later stage which led to getting offers from renowned organisations. Based on my corporate journey, I have made up my mindset and gained confidence to open my own start-up.”-(Investment Banking), Entrepreneur, Compute Value

It’s been 3 years that I have entered into the Corporate World, and whenever there comes any situation where we do not know what to do, the learnings which I have received during this course has helped me to solve them. I always feel proud to be a part of this unique Program.”

It’s been 3 years that I have entered into the Corporate World, and whenever there comes any situation where we do not know what to do, the learnings which I have received during this course has helped me to solve them. I always feel proud to be a part of this unique Program.”(Corporate Finance & Investment Banking)

Debt Syndication, Resurgent India

They nourished us in such a manner that we were ready to outperform in the Corporate world. Be it the Financial Modeling, Risk Modeling, Valuation Modeling and many other in Investment Banking, OR be it the Fundamental Analysis, Technical Analysis, Live Stocks Trading in Wealth Management OR be it the Debt Securitization, Mortgage-backed Securities, Debt Syndication in Corporate Finance, we learned them all from Industry Professionals. Just because of those learnings, I was able to get into Fortune 500 Credit rating Company, Moodys as an Analyst. I would say my investment in this course has proved to be the best investment in my life.”

They nourished us in such a manner that we were ready to outperform in the Corporate world. Be it the Financial Modeling, Risk Modeling, Valuation Modeling and many other in Investment Banking, OR be it the Fundamental Analysis, Technical Analysis, Live Stocks Trading in Wealth Management OR be it the Debt Securitization, Mortgage-backed Securities, Debt Syndication in Corporate Finance, we learned them all from Industry Professionals. Just because of those learnings, I was able to get into Fortune 500 Credit rating Company, Moodys as an Analyst. I would say my investment in this course has proved to be the best investment in my life.”(Investment Banking),

Currently pursuing PhD in Finance

Earlier was in Business Analytics, Moodys

The structure of this course with its combination of 1 year rigorous study period in classrooms and then another 1 year training in the corporate world offers humongous exposure and pre - placement opportunities as it is designed and only taught by Industry led experts, CFOs, National Heads of MNCs which helped us to build connections and understand what is expected in the Industry! I would like to thank Chitkara University, CA (Dr) Aman Chugh and the Corporate Professionals for their continuous support and guidance throughout my journey which further helped me land an offer at the Big 4!"

The structure of this course with its combination of 1 year rigorous study period in classrooms and then another 1 year training in the corporate world offers humongous exposure and pre - placement opportunities as it is designed and only taught by Industry led experts, CFOs, National Heads of MNCs which helped us to build connections and understand what is expected in the Industry! I would like to thank Chitkara University, CA (Dr) Aman Chugh and the Corporate Professionals for their continuous support and guidance throughout my journey which further helped me land an offer at the Big 4!" (Corporate Finance), Business Assurance, Ernst Young

The Industry Experts brought to light a number of sectors such as Valuations and Advisory, Portfolio Management, Corporate Finance, Investment Advisory, Business Analysis and so on. Not only I got an engaging job, I got priority from seniors due to my wide knowledge and exposure.

The Industry Experts brought to light a number of sectors such as Valuations and Advisory, Portfolio Management, Corporate Finance, Investment Advisory, Business Analysis and so on. Not only I got an engaging job, I got priority from seniors due to my wide knowledge and exposure.(Investment Banking),

Valuation & Consulting

Knight Frank Advisory

“The best thing about the University is the cross-culture interaction between students from the various parts of the world. After attending this program, I got to know the importance of Networking and how helpful it is in our lives. This course is designed in such a way that everyone is interacting with each other.”

“The best thing about the University is the cross-culture interaction between students from the various parts of the world. After attending this program, I got to know the importance of Networking and how helpful it is in our lives. This course is designed in such a way that everyone is interacting with each other.”(Corporate Finance),

Business Finance & Analysis

ZNet Technologies

The program is well-developed whether you want to be an entrepreneur, work for a global brand, or help a startup scale. Apart from that, there's an extraordinary range of endless internship opportunities and entrepreneurial culture. This journey has pushed me to reach my full potential and has been well worth it as it has developed the skill set required for success in the business environment.

The program is well-developed whether you want to be an entrepreneur, work for a global brand, or help a startup scale. Apart from that, there's an extraordinary range of endless internship opportunities and entrepreneurial culture. This journey has pushed me to reach my full potential and has been well worth it as it has developed the skill set required for success in the business environment.(Corporate Finance),

Finance & Accounts, Medtronics

My experience during the MBA course was full of tremendous opportunities where I improved my overall personality, enhanced my knowledge and skills which are highly recommended in the corporate world. We had the privilege of getting directly connected with the top-level administrators of various reputed companies. I thoroughly enjoyed my journey in association with experienced faculties who were always ready to extend their helping hands towards us. The constant efforts and guidance made me corporate ready and as a result, I got placed in a multinational company which is a great opportunity for a fresher like me.

My experience during the MBA course was full of tremendous opportunities where I improved my overall personality, enhanced my knowledge and skills which are highly recommended in the corporate world. We had the privilege of getting directly connected with the top-level administrators of various reputed companies. I thoroughly enjoyed my journey in association with experienced faculties who were always ready to extend their helping hands towards us. The constant efforts and guidance made me corporate ready and as a result, I got placed in a multinational company which is a great opportunity for a fresher like me.(Corporate Finance),

Strategic Corporate Finance, Thermofisher Scientfic

I am very pleased and thankful for the programme (Investment Banking, Corporate Finance and Wealth Management) being started by CA (Dr) Aman Chugh. Through this programme, we got to enhanced our knowledge regarding current updates, economical changes, market affairs, and many more.This programme shaped me from day one to face the corporate world. The environment in the placement cell (Mini Corporate World would be the right term) has taught me to be innovative and meticulous in my approach to any strategic goals set for a professional. Whether the work scope is within the domain of expertise or not, a proper approach can solve all issues at hand. It’s because of the knowledge I gained from this programme. It was the support of my teachers/ mentors which motivated me to THINK BIG & GET BIG.

I am very pleased and thankful for the programme (Investment Banking, Corporate Finance and Wealth Management) being started by CA (Dr) Aman Chugh. Through this programme, we got to enhanced our knowledge regarding current updates, economical changes, market affairs, and many more.This programme shaped me from day one to face the corporate world. The environment in the placement cell (Mini Corporate World would be the right term) has taught me to be innovative and meticulous in my approach to any strategic goals set for a professional. Whether the work scope is within the domain of expertise or not, a proper approach can solve all issues at hand. It’s because of the knowledge I gained from this programme. It was the support of my teachers/ mentors which motivated me to THINK BIG & GET BIG.(Corporate Finance),

Finance Operations, Olx

First and foremost, I will not even attempt to express how much I benefited from and enjoyed this program. There's no point in expounding on how well-organized it was, what a perfect balance of serious intent and good-natured fun it turned out to be, how impressive my colleagues were, and how much your generosity enriched my life. I'll never forget what Aman Sir had said to me: "double-check your work" & "learn from your mistakes rather than dwelling on them."

First and foremost, I will not even attempt to express how much I benefited from and enjoyed this program. There's no point in expounding on how well-organized it was, what a perfect balance of serious intent and good-natured fun it turned out to be, how impressive my colleagues were, and how much your generosity enriched my life. I'll never forget what Aman Sir had said to me: "double-check your work" & "learn from your mistakes rather than dwelling on them."

We didn't muddle things up in this program instead we learned them from the ground up. This course was highly recommended to me by previous students and i think it's worth every single penny spent on me during this MBA Program.

(Corporate Finance), Hedge Fund Accounting, Citco

For General Queries

Ms. Anjali Jasrai

Program Head

CXOs NextGen Center of Excellence in Finance

Chitkara University

Mob – +91 8264097714